Dynasty Trusts

Americans for Tax Fairness, through principal author, Bob Lord with assistance from some academic smarty pants whose names are recognizable, published an interesting report earlier this year on the persistence of Dynasty Trusts. Here is a sample from the Executive Summary:

Dynastic wealth has been with us since before the American Revolution. But the accumulations of wealth by ultrarich families in recent decades now exceed even those from the Gilded Age of the late 19th century. And huge family fortunes continue to pile up day after day with no end in sight. This unceasing buildup of private wealth makes our society less equal, our economy less stable and our democracy less secure. Taxes levied on the intergenerational transfer of wealth are supposed to curb this accumulation, but big loopholes in federal tax law allow it to mostly proceed unchecked. Payment of estate, gift and generation-skipping taxes (collectively known as wealth-transfer taxes) have become for all practical purposes optional for the ultrawealthy. Ultrarich families use dynasty trusts—the term for a variety of wealth-accumulating structures that remain in place for multiple generations—to ensure their fortunes cascade down to children, grandchildren and beyond undiminished by wealth-transfer taxes.

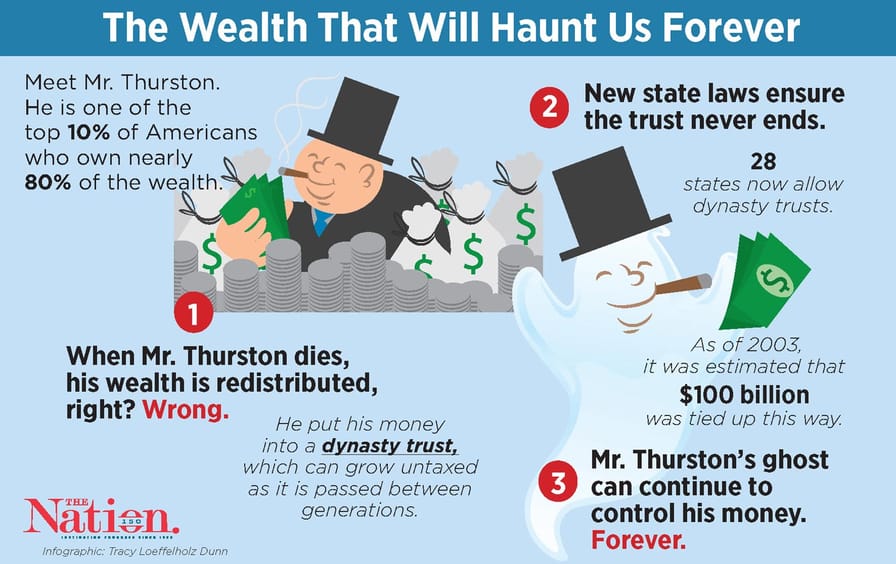

The picture below is from a different source but it alarmingly (I guess) depicts the problem.

I should admit that I avoid estate and gift taxation like sick man avoids a conference of anti-vaxers. I have ever since I finished my Estate and Gift tax exam many many moons ago. I mean, if the estate tax is supposed to preclude the concentration and amassing of generational wealth . . . well, I got bad news for us all. Anyway, the most I can intelligently state with regard to dynasty trusts and the report is that somehow I get the feeling it has something to do with charitable giving under the Income and Estate tax systems. So rather than completely expose my ignorance, I will just paste the Table of Contents and let the estate and gift tax geeks out there figure it out:

Table of Contents

2 EXECUTIVE SUMMARY

5 BACKGROUND: RISE AND DECLINE OF THE ESTATE TAX

7 SUPERCHARGED ESTATE TAX AVOIDANCE: THE RISE OF DYNASTY TRUSTS

10 Generation-skipping Tax Exemption Creates and Inflates Dynasty Trusts

12 Valuation Discounts for Interests in Family-controlled Entities

13 Intentionally Defective Grantor Trusts (IDGTs)

16 Zeroed-out Grantor Retained Annuity Trusts

17 Irrevocable Life Insurance Trusts (ILITS) and Use of “Crummey Powers”

19 Effective Gift Tax Rate

19 Impact of Stepped-up Basis on Dynastic Wealth Accumulation

22 SCALE OF WEALTH TRANSFER TAX AVOIDANCE

22 Estate Tax Avoidance by Dynasty Trust Assets Over the Next 30 Years

22 Extensive Exploitation of Tax Loopholes by the Ultrarich

25 Case Examples of the Use of Family Dynasty Trusts to Avoid Taxes

27 ALARMING FUTURE OF DYNASTIC WEALTH

30 WEALTH DEFENSE INDUSTRY FUELS DYNASTIC WEALTH ACCUMULATION AND FRUSTRATES CHARITABLE IMPULSES

31 SOCIETAL PROBLEMS OF DYNASTIC WEALTH

31 Concentration of Political Power

33 Dynastic Wealth Escapes Public Oversight or Regulation

35 REVERSING DYNASTIC WEALTH ACCUMULATION

37 CONCLUSION

38 ENDNOTES

dkj